Mining cryptocurrencies has become increasingly popular as more individuals and companies venture into the realm of blockchain technology. However, despite the lucrative potential, there are pitfalls that can lead to significant losses. In this article, we will explore five common mistakes that miners often make when withdrawing their earnings and provide practical tips on how to avoid these errors.

One of the most prevalent mistakes is failing to verify the withdrawal address. It’s crucial to ensure that the wallet address you are sending your earnings to is correct. A small typo can lead to the irreversible loss of funds. Always double-check the address before confirming any transaction. Using copy and paste functions directly from your wallet can mitigate this risk, as typing addresses manually increases the chance of human error. Also, consider sending a small test transaction to the address before committing larger amounts.

Another mistake that miners often make is disregarding transaction fees. Each withdrawal from an exchange or wallet incurs a fee, and these can vary significantly. By not accounting for these fees, you might withdraw less than expected or fail to send enough funds to cover the withdrawal at all. It can be beneficial to stay informed about current fee structures on exchanges and adjust your withdrawal amounts accordingly. Understanding when to transact, especially during periods of lower network congestion, can also save you money.

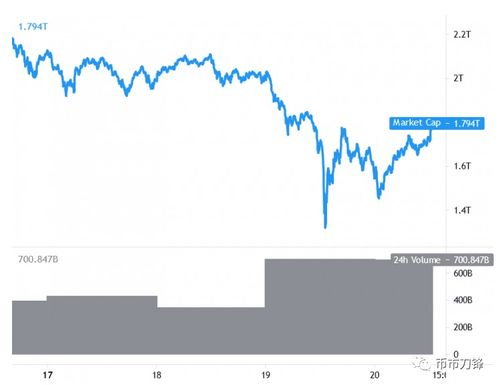

Failure to keep track of different cryptocurrencies can pose another risk. With numerous digital currencies in existence, many miners might find themselves withdrawing various assets, including Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG). It’s essential to be aware of the unique aspects of each cryptocurrency, including their respective wallets and potential value fluctuations. By maintaining a detailed record of your earnings and understanding the specific protocols for each asset, you can ensure more streamlined and secure withdrawals.

Moreover, miners frequently overlook the importance of account security. With the rise of cyber threats, ensuring that your cryptocurrency exchanges and wallet accounts are secure is paramount. Implementing strong, unique passwords and enabling two-factor authentication can significantly reduce the risk of unauthorized access. Additionally, keeping software wallets updated and using hardware wallets for large amounts can further protect your earnings. Don’t forget, even the most advanced mining rig is only as secure as the measures you take to safeguard your accounts.

The final mistake to avoid is neglecting tax obligations. Cryptocurrencies are considered taxable assets in many jurisdictions, which means any withdrawal could impact your tax responsibilities. Failing to report your earnings correctly can lead to penalties and unexpected complications with tax authorities. Keeping comprehensive records of all transactions, including withdrawals, will aid in making tax filings more manageable. Consulting a tax professional who understands cryptocurrency can help you navigate these waters more effectively.

By being aware of these common mistakes and implementing strategies to avoid them, you can maximize your mining profits while minimizing potential losses. The cryptocurrency landscape, brimming with opportunities, requires miners to remain vigilant and informed about best practices. From you, the miner in the thick of the action, to the machines that do the heavy lifting, every aspect plays a crucial role in the overall success of your mining endeavors. Welcome to the world of cryptocurrencies, where your diligence pays off substantially on every transaction.

This savvy guide on crypto mining withdrawals cleverly exposes five pitfalls—like overlooking fees or ignoring security—and offers witty avoidance tips, making it a must-read for savvy miners eager to safeguard their gains!