The relentless hum of crypto mining rigs, a symphony of silicon and electricity, has long been synonymous with environmental concerns. Visions of sprawling data centers guzzling power, contributing to carbon emissions, have painted a bleak picture. But a revolution is underway, a shift towards green crypto mining equipment that promises not just environmental responsibility, but also a compelling return on investment (ROI) and long-term viability. The future of crypto mining hinges on embracing this transition.

For too long, the discourse surrounding cryptocurrency mining has been dominated by its energy footprint. Critics point to Bitcoin’s proof-of-work (PoW) consensus mechanism, a computationally intensive process that demands immense power to secure the network. This energy demand, often met by burning fossil fuels, has cast a shadow over the entire industry. However, innovation is brewing, with advancements in hardware and a growing emphasis on renewable energy sources offering a path towards sustainability. The narrative is shifting from energy hog to energy innovator, and that shift is attracting significant investment.

Green crypto mining equipment encompasses a range of technologies and strategies. At its core lies the development of more energy-efficient mining rigs. These rigs, often utilizing Application-Specific Integrated Circuits (ASICs) designed for specific cryptocurrencies like Bitcoin, are constantly being optimized to deliver higher hash rates per watt. This means more computational power with less energy consumption, directly translating to lower operating costs and a smaller environmental footprint. The competition among manufacturers to create the most efficient ASIC is fierce, driving rapid advancements in the field. These new machines aren’t just more efficient; they’re often quieter and produce less heat, further reducing operational overhead.

Beyond hardware, the sourcing of electricity is paramount. Mining operations are increasingly turning to renewable energy sources such as solar, wind, and hydroelectric power. Large-scale mining farms are being strategically located in regions with abundant renewable energy resources, allowing them to power their operations with clean, sustainable energy. These facilities are not only reducing their carbon footprint but also benefiting from lower electricity costs, a significant advantage in the highly competitive mining landscape.

The ROI of green crypto mining equipment is multifaceted. Firstly, lower electricity costs translate directly into higher profit margins. As energy efficiency increases and renewable energy becomes more accessible, mining operations can significantly reduce their operating expenses. Secondly, embracing sustainable practices can enhance a company’s reputation and attract environmentally conscious investors. In a world increasingly focused on sustainability, a commitment to green mining can be a powerful differentiator. Finally, proactive adoption of green technologies can help mitigate the risk of future regulations and taxes related to carbon emissions. Governments worldwide are increasingly scrutinizing the environmental impact of cryptocurrency mining, and those who are prepared will be better positioned to navigate the evolving regulatory landscape.

The long-term viability of crypto mining hinges on its ability to become sustainable. As environmental awareness grows and regulatory pressures intensify, mining operations that fail to adapt will face increasing challenges. Green crypto mining equipment is not just a trend; it’s a necessity for survival in the long run. By embracing energy efficiency, renewable energy sources, and responsible waste management practices, the crypto mining industry can ensure its continued growth and contribute to a more sustainable future. The shift towards green mining is not just good for the planet; it’s good for business.

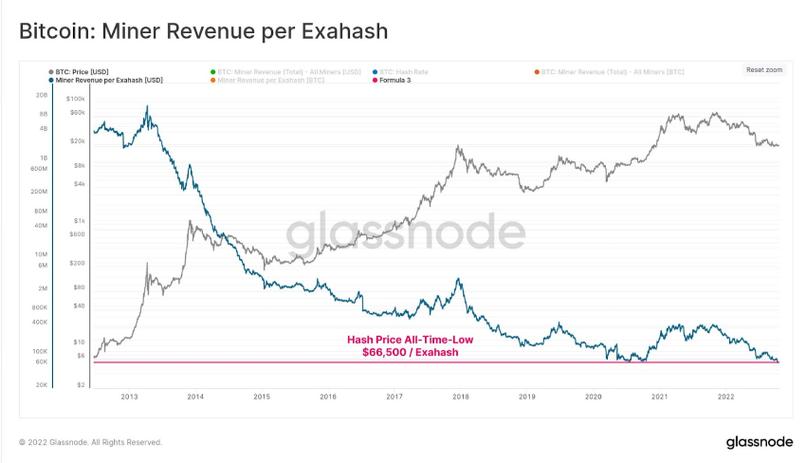

Consider the impact on specific cryptocurrencies. Bitcoin, with its energy-intensive proof-of-work consensus mechanism, stands to benefit enormously from the adoption of more efficient ASICs and renewable energy sources. As Bitcoin’s price fluctuates, the profitability of mining can swing dramatically. Lower energy costs provide a buffer against these fluctuations, making Bitcoin mining more resilient in the face of market volatility. Furthermore, a greener Bitcoin network can alleviate concerns about its environmental impact, attracting a wider range of investors and potentially boosting its long-term value. Dogecoin, while initially conceived as a meme coin, also relies on mining, and the same principles of energy efficiency and renewable energy apply. While Dogecoin’s hashing algorithm differs from Bitcoin’s, advancements in GPU-based mining can still lead to significant improvements in energy consumption. Similarly, Ethereum, although transitioned to Proof-of-Stake(PoS) model which is less energy consumption, the mining farms that used to mine eth are seeking to use greener methods to mine other cryptocurrencies.

Beyond individual cryptocurrencies, the development of green mining infrastructure has broader implications. It can spur innovation in energy storage, grid management, and other related fields. For example, mining operations located near renewable energy sources can help stabilize the grid by absorbing excess energy during periods of low demand. This can make renewable energy projects more economically viable and accelerate the transition to a cleaner energy system. The symbiotic relationship between crypto mining and renewable energy has the potential to drive significant technological advancements and create new economic opportunities.

The journey towards green crypto mining is not without its challenges. The initial investment in more efficient equipment and renewable energy infrastructure can be significant. However, these upfront costs are often offset by long-term savings on electricity and the potential for increased profitability. Furthermore, access to renewable energy sources can be limited in some regions, requiring innovative solutions such as on-site generation and energy storage. Overcoming these challenges will require collaboration between mining companies, technology providers, and policymakers. By working together, we can create a regulatory environment that encourages sustainable practices and fosters innovation in the green crypto mining sector.

In conclusion, green crypto mining equipment represents a paradigm shift in the cryptocurrency industry. It offers a path towards environmental responsibility, increased ROI, and long-term viability. By embracing energy efficiency, renewable energy sources, and responsible waste management practices, the crypto mining industry can secure its future and contribute to a more sustainable world. The future of crypto is green, and the time to invest in that future is now.

Examines eco-friendly crypto mining hardware, weighing initial investment against sustained profitability and environmental impact. A vital assessment for sustainable blockchain futures, uncovering surprising cost benefits.