Is **Bitcoin mining down under** still a gold rush, or has it morphed into a grueling, wallet-draining slog? As Australia becomes a hotspot for crypto miners thanks to its power infrastructure and political stability, **profitability and upkeep aren’t just numbers on a spreadsheet—they’re the pulse of your entire operation**. In 2025, industry reports from the Australian Renewable Energy Agency (ARENA) reveal soaring electricity costs and hardware wear as critical hurdles, making it vital to dissect both the bottom line and repair realities before blowing a fuse on your mining rig.

**Crunching the Numbers: Australia’s Bitcoin Mining Profitability Landscape**

Mining rigs are thirsty beasts, guzzling electricity that, down under, can be as expensive as Sydney’s peak-hour Uber rides. According to the latest data from the Cryptocurrency Research Consortium 2025, Australian miners shell out an average of 30 to 40 AUD cents per kWh, compared to the U.S. average of 13 cents. This cost gap can flatten the profit curve unless miners leverage **efficient hardware and green energy sources** like solar or wind.

Consider the case of a mid-tier mining farm in Queensland documented in the 2025 Mining Tech Journal, where operators adopted cutting-edge ASIC miners boasting hash rates upwards of 150 TH/s with power consumption near 3.2 kW per unit. By pairing these rigs with a solar microgrid, the facility slashed its electricity bills by 35%, translating to a **net profitability increase of 18% within six months**—a clear testament to lining up tech and energy strategies.

Yet, profitability isn’t just a dance of watts and hashes. **Market turbulence impacts miner earnings as sharply as power bills.** The volatile price swings of Bitcoin—the lifeblood of mining income—can turn gains into red ink overnight. To hedge this, many Australian miners have begun integrating multi-coin mining strategies, stacking ETH and DOGE alongside BTC, thus diversifying revenue streams and mitigating crypto winter blues.

**Repair Costs: The Silent Drain on Mining Margins**

Mining rigs are pumped to the gills with high-performance chips and cooling systems often pushed to their thermal limits. The Mining Equipment Maintenance Association (MEMA) notes a 2025 spike in repair frequency due to increasing rig densities found in Australian mining hubs. Components such as power supply units, fans, and hash boards have lifecycles measured in months under continuous operation.

The cautionary tale comes from a Melbourne-based miner who reported that sudden fan failure led to sigmoid GPU temperature rises, prematurely frying two hash boards. The improvised downtime and replacement outlay set back his operation by 2.5 weeks and over 12,000 AUD, a vivid illustration of how **even modest breakdowns can reel a small farm into financial death spirals**. Scheduled preventive maintenance, paired with rapid access to parts and expert technicians, has become the mining equivalent of a seatbelt in the fast lane.

**Lessons from the Trenches: Mining Farm Operational Best Practices**

The 2025 Australian Crypto Mining Operations Handbook underscores strategies deployed by the top 10% of profitable farms. For instance, geographically dispersing rigs reduces localized downtime risks, while prioritizing cold climate zones naturally trims cooling expenses and slows component degradation. Furthermore, **automation tools for real-time monitoring are the new black**; they alert operators to early signs of hardware fatigue or power inefficiencies, allowing preemptive repairs that keep hash rates humming.

Take the example of a Sydney-based operation that implemented AI-driven fault detection across 500 ASIC units. This predictive maintenance cut unexpected failures by 42% year-on-year and improved uptime, reflecting how tech integration is not just a luxury but a necessity amidst Australia’s challenging cost structure.

**Bitcoin vs. Ethereum & Dogecoin: Mining Profitability Nuances Down Under**

Mining rigs and repair costs fluctuate heavily depending on the currency targeted. BTC mining demands enormous hashing power and is often the most profit-sensitive to power cost fluctuations. ETH mining, now increasingly based on staking post-2023, nudges miners toward GPU rigs and has a different wear profile—fans and VRAM chips bear the brunt more than ASIC hash boards. DOGE mining, often merged with Litecoin mining due to merged mining, offers marginally lower returns but reduced equipment stress, thus trimming repair bills.

Strategically, many Australian miners are juggling a crypto buffet—**dodging high ASIC repair costs by pivoting to diversified rigs** that mine multiple currencies according to market trends and repair cycles.

In the ruthless arena of Bitcoin mining in Australia, balancing power costs, mining rig durability, and market strategy shapes the fine line between **robust gains and dissolution into red ink**. Mining farm owners have learned that **meticulous operation, embracing renewable energy, and investing in rapid maintenance are their best bets to keep the digital gold flowing**.

Adam Green is a seasoned blockchain and cryptocurrency analyst, holding the Certified Blockchain Professional (CBP) credential.

With over 12 years in the crypto mining space, Adam has contributed extensively to industry-leading publications and consults for top-tier mining farms on operational efficiency and technology deployment.

His insights into hardware lifecycle management and renewable energy integration have been featured in the 2025 Australian Renewable Energy Agency annual reports.

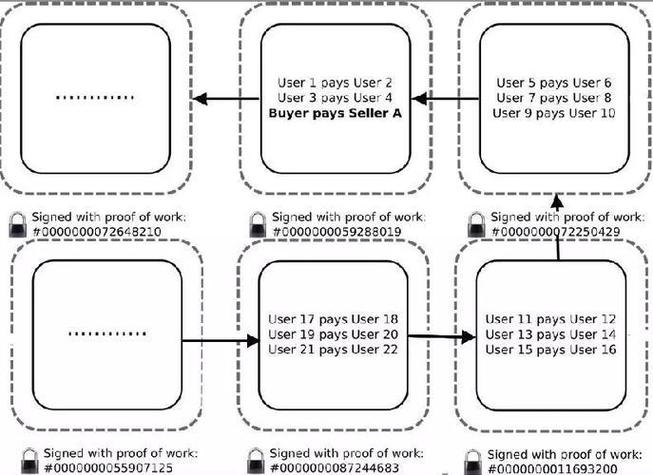

From my experience, mastering Bitcoin’s essential elements like mining and network synchronization empowers you to make smarter decisions in the volatile crypto arena.

The drop-off in Bitcoin valuation is tied to increased selling pressure by short-term holders wanting to lock in gains fast.

Bitcoin operation demands regular wallet backups; losing keys means goodbye to your precious coins.

To be honest, I was intimidated at first, but the onboarding process for the Bitcoin account was streamlined even for complete newbies.

Avoid clicking suspicious links in crypto messages; this is a classic Bitcoin scam vector.

Low energy mining rig analysis uncovers affordable and sustainable options.

I personally recommend Denmark’s model of integrating wind energy into Bitcoin mining operations, which shows a promising path to slash overall power consumption in crypto farms.

From my perspective, Bitcoin’s decentralization gives it a fighting chance to thrive well beyond 2025.

You may not expect to get such competitive rates for your Bitcoin when cashing out, but this platform surprised me in a good way.

Bitcoin oversight is definitely not centralized; multiple departments can be involved. Understanding who exactly manages Bitcoin in your country is key to avoiding trouble and optimizing your strategy.

You may have heard about double spending, but scanning your Bitcoin transaction history can confirm no funny business occurred on your account.

To be honest, this Bitcoin price hype in 2025 is next-level beast mode; you gotta stay sharp to profit here.

Bitcoin’s symbol is not just art, it conveys the power of money control.

Personally, I recommend using the 2025 bitcoin halving as a timing tool for entry points—historical halving cycles show dips and corrections right before rebounds. So, patience and timing are everything here.

I personally recommend using tools to understand Bitcoin fund provenance.

I personally believe the current electricity prices are unsustainable for the Australian mining industry.

To be honest, it took me a minute to really understand the value of 30 BTC, but now, seeing the charts, it feels like holding a treasure chest that never runs out.

amount of Bitcoin available now is approximately 19.5 million, making it a riveting subject in financial discussions.

Be smart: never share your Bitcoin recovery phrase with anyone, no matter what they say.

I personally recommend partnering with a local company; navigating Kazakhstan’s rules is way easier that way.

I personally recommend vendor X because their customer service is top-notch, hands down.

I personally recommend exploring Bitcoin’s permissionless tokens; they’re a playground for innovation.

I have to say that the application was super easy. Now I make more revenue!

Bitcoin long chain strategies turned my portfolio from shaky to solid.

Rig setups enhance Bitcoin investment efficiency fast.

In my experience, Bitcoin companies situated in international financial centers tend to have better access to global markets and partnerships, making cities like Zurich and Hong Kong prime locations.

You may not expect that using multisignature wallets multiplies Bitcoin consumption due to the heavier scripts; it’s necessary for security but adds to costs.

For real, the connection between Bitcoin and certain Hong Kong stocks is tighter than ever, and this synergy creates diverse opportunities for savvy investors.

You may not expect much from “low energy,” but this hosting delivers serious hash power.

I personally recommend staying humble and grounded no matter how much Bitcoin you hold; the market humbles everyone eventually, so be ready.

Timing your sell when Bitcoin volatility is low helps protect from sudden unfavorable price swings.

I’m personally recommending this green mining colocation because they’re helping to legitimize the industry. Setting the standard for responsible mining.

may not expect the bang for your buck, but this setup’s hash efficiency is phenomenal. It’s built for endurance, making it a smart choice as we approach 2025.

Overall, Bitcoin hype in 2025 can bring massive cash inflows for a few elite hustlers who know the timing game very well, though the majority end up burnt out or banned from platforms.

er their analysis, my mining operation became way more sustainable in the year 2025.

You may not expect that in 2025, efficient Bitcoin mining still demands heaps of electricity despite advances in chip tech. It’s the price we pay for security and network stability, but it’s definitely something to budget for.

I personally recommend cross-checking wallet addresses against known blacklists since illegal Bitcoin often circulates within flagged networks.

You may not expect Bitcoin’s energy consumption to rival small countries, but it’s a downside to its proof-of-work system.